The Commission analysis in this report is based on statistics for 2024 received from Member States in relation to the application of the e-commerce package

1. Introduction

Against a backdrop of explosive growth in e-commerce activity and a fragmented regulatory framework for the collection of VAT on e-commerce supplies, the VAT e-commerce package, which came into effect on 1 July 2021, introduced a number of VAT and customs related reforms. These reforms were designed to help navigate the challenges presented by the modern global economy and to modernise and simplify the collection of tax on e-commerce transactions.

The Commission analysis in this report is based on statistics for 2024 received from Member States in relation to the application of this e-commerce package. This report sets out details of the total number of registrations in all three One-Stop Shop (OSS) schemes, namely, the Union OSS, the non-Union OSS and the Import OSS, on 31 December 2024. It also provides details on the total amount of VAT that was declared in each of these schemes in 2024. This report also gives an account of the evolution of these registration and declaration figures since the introduction of the OSS schemes in July 2021.

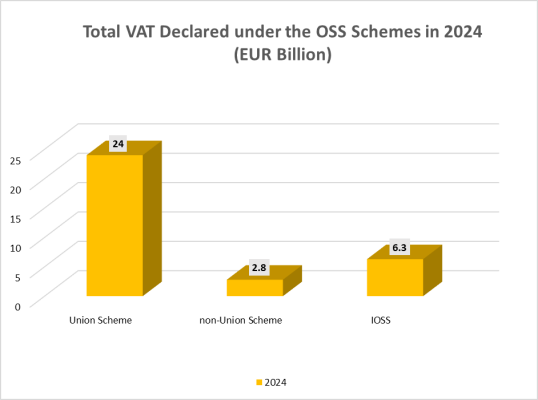

2. VAT declared in the One Stop Shop (OSS) special schemes in 2024 (the Union scheme, the non-Union scheme and the Import scheme)

In total, in 2024, over EUR 33 billion of VAT was declared via the three OSS schemes (EUR 24 billion in the Union scheme, EUR 2.8 billion in the non-Union scheme and EUR 6,3 billion in the Import scheme). These figures validate the popularity of the e-commerce simplifications among traders in the e-commerce market and further demonstrate how the e-commerce package has enabled the Commission to achieve its aim to modernise and simplify the collection of VAT on e-commerce transactions.

3. VAT Declared Through OSS Schemes: 2021–2024 Comparative Analysis

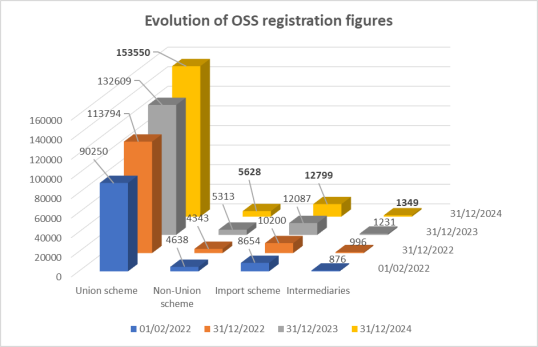

Since the 2021 report covers only 6 months of application, the figures for that year are presented as such (without extrapolation) to maintain consistency and accuracy across the reporting period. While this means that 2021 cannot be directly compared to the full-year figures for 2022, 2023, and 2024, it ensures that all reported totals reflect only actual declared amounts.

Figure 2 shows that the overall VAT declared in each of the three schemes has increased year-on-year since the package came into force. In 2024, the total VAT declared across the three schemes rose by EUR 6.8 billion, from EUR 26.3 billion in 2023 to EUR 33.1 billion in 2024, representing a 26% increase compared to the previous year.

Between 2021 and 2024, a total of approximately EUR 88.05 billion in VAT was declared under the OSS and IOSS schemes, based on actual data. In the first six months of 2021 alone, around EUR 7.75 billion was collected, followed by EUR 20.9 billion in 2022, EUR 26.3 billion in 2023, and EUR 33.1 billion in 2024. This total confirms the significant and growing contribution of the OSS and IOSS schemes to VAT revenue collection across the EU since their introduction in mid-2021. In particular, the Import One-Stop Shop (IOSS) scheme saw a substantial increase in 2024, with VAT declared rising by 62% to EUR 6.3 billion, underpinning the ever-increasing importations of low value consignments into the EU.

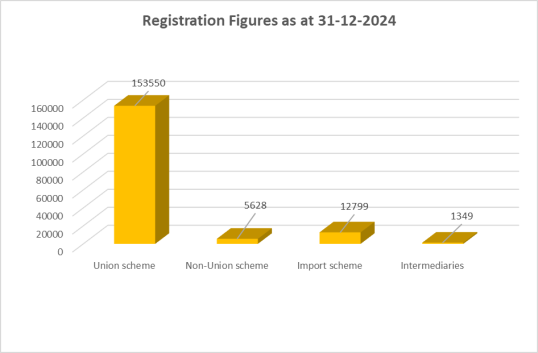

4. Registration numbers

As of 31 December 2024, the registration figures clearly demonstrate that the e-commerce package reforms have been widely embraced by traders. The consistent upward trend in registrations across all three OSS schemes in 2024 reflects the strong interest and confidence businesses have in the simplifications introduced by the package. In total, over 170,000 traders were registered under the Union OSS, non-Union OSS, and Import OSS schemes by the end of 2024, an encouraging indicator of the continued success and growing appeal of the EU VAT e-commerce framework.

In 2024, the number of traders registered under the Union OSS scheme grew significantly, rising from 132,609 to 153,550. This increase of 20,941 registrations represents a 16% growth compared to the end of 2023, highlighting the continued uptake of the scheme among EU-based businesses.

The non-Union OSS scheme also saw a continued steady growth in 2024. The number of registered traders increased from 5,313 to 5,628, marking an increase of 315 registrations, or approximately 6% year-on-year.

Similarly, the Import OSS (IOSS) scheme experienced an upward trend. Registrations rose from 12,087 at the end of 2023 to 12,799 at the end of 2024, representing an increase of 712 traders, which also corresponds to a 6% growth compared to the previous year.

The number of intermediaries, who act on behalf of third country operators under the IOSS scheme also continued to grow. Registrations increased from 1,231 in 2023 to 1,349 in 2024, a rise of 118 intermediaries or approximately 10% year-on-year. This trend supports the observation that the number of third country operators engaging with the EU VAT e-commerce system is also increasing, further underscoring the global relevance and effectiveness of the scheme.

These increases across all components of the OSS and IOSS schemes reflect the growing trust in and reliance on the EU VAT e-commerce package as a simplified and efficient tool for cross-border VAT compliance.

5. E-Commerce VAT Reform: Progress and Future Direction

Overall, these figures are encouraging and show a continued success of the e-commerce package. The latest registration figures also showcase how the EU VAT e-commerce package has simplified the process of VAT compliance and minimised the administrative burden and costs for traders, removing barriers and allowing traders to expand their business more easily within the EU. The appeal of these simplifications is clearly evident as more businesses opt to use these schemes to declare and remit the VAT due on their eligible supplies to consumers in the EU. The yearly increase in OSS registration numbers also reduces the administrative burden for tax administrations as they no longer have to issue VAT registrations to non-established traders who make eligible supplies of goods and services to consumers in their Member State. Instead, traders who opt to register in an OSS scheme can deal with their VAT compliance obligations in one language via the tax administration of the Member State in which they are registered/established, without having to register for VAT in other Member States, even though their sales are EU-wide.

Following the adoption of the VAT in the Digital Age (ViDA) package in 2025, its phased implementation in the coming years is expected to further build on the success of the e-commerce VAT reforms. By, expanding the scope of the OSS to cover more B2C transactions, and moving towards a single VAT registration in the EU, ViDA will likely lead to even greater uptake of the OSS schemes. The steady increase in registrations observed in 2024 reflects growing business confidence in simplified VAT compliance mechanisms.

In parallel, the incentivised IOSS mechanism and proposed removal of the €150 customs exemption threshold under the EU Customs Reform is set to align customs and VAT treatment of B2C consignments, further closing loopholes and enhancing fair competition. Once implemented, this measure is expected to improve compliance, reduce fraud, and increase the attractiveness of the Import OSS for businesses engaged in cross-border e-commerce.

Together, these reforms will reinforce the EU’s goal of creating a modern, fair, and fraud-resistant VAT and customs framework fit for the digital economy.